Purpose

Fueling perpetual growth; investing in bold visions

Over many years of investment experience, JAFCO Group Co., Ltd. ("JAFCO" or the "Company") continued to invest in new challenges of companies and entrepreneurs, based on its conviction that continued investment leads to the realization of a sustainable society. As issues surrounding the global environment and the global economy become increasingly complex, the Company will create a cycle of new growth and contribute to the realization of a sustainable society by making bold investments in challenges that create new value and committing ourselves to their growth.

Mission

Commit to new business creation and jointly shape the future

Since establishment, we have created various innovative products and services jointly with entrepreneurs. Our mission is to open up new frontiers with our stakeholders by committing to creating new businesses that are in demand.In realizing its Purpose, the Company will continue to work towards our mission which incorporates its desire that has remained unchanged since its inception.

Track record

We have continued to generate results over the years while experiencing major economic crisis and changes in industrial structure.

As of March 31, 2025

Years of VC Experience

52 years

Portfolio IPOs

1,039 co's

Cumulative investment

4,221 co's

Funds under management

¥458.4 billion

No. of investors

approx. 400

Our Approach

JAFCO employs the following five maxims in our business operation.

Reproduce success by passing on our expertise

JAFCO is in the venture capital business for over 40 years. We capitalize on the accumulated expertise as our organizational strength to provide post-investment support, thereby increasing the chances of our portfolio companies to thrive and achieve a big success. We also believe that building up our successful track record broadens the base of entrepreneurs.

Create next-generation businesses

JAFCO works with all portfolio companies not only as an investor, but also with a mindset of "Co-Founder." Our early involvement in new business planning and co-founding a business allow our portfolio companies to prosper, and also JAFCO and its funds to achieve high performance.

Develop globally, focus locally

Day-to-day activity rooted in the local community is important for venture investment. We establish and manage funds in the US and Asia with our local capitalists to diversify risks regionally. Capitalizing on our strength as a Japanese VC firm, our BD (business development) group members offer cross-border support covering Japan, the US, and Asia.

Work earnestly with entrepreneurs to raise corporate value

There are various hurdles to overcome in order to bring businesses up to speed. JAFCO works earnestly with entrepreneurs at any phase of startup. By working together to make better decisions through active discussions, we fulfill our common objective of raising corporate value.

Preserve discipline and transparency as a VC pioneer

To increase risk capital through venture capital funds, it is important to build a structure that ensures credible fund management for investors. As a pioneer that established Japan's first VC fund, we will preserve discipline and transparency of our funds based on consistent management policies.

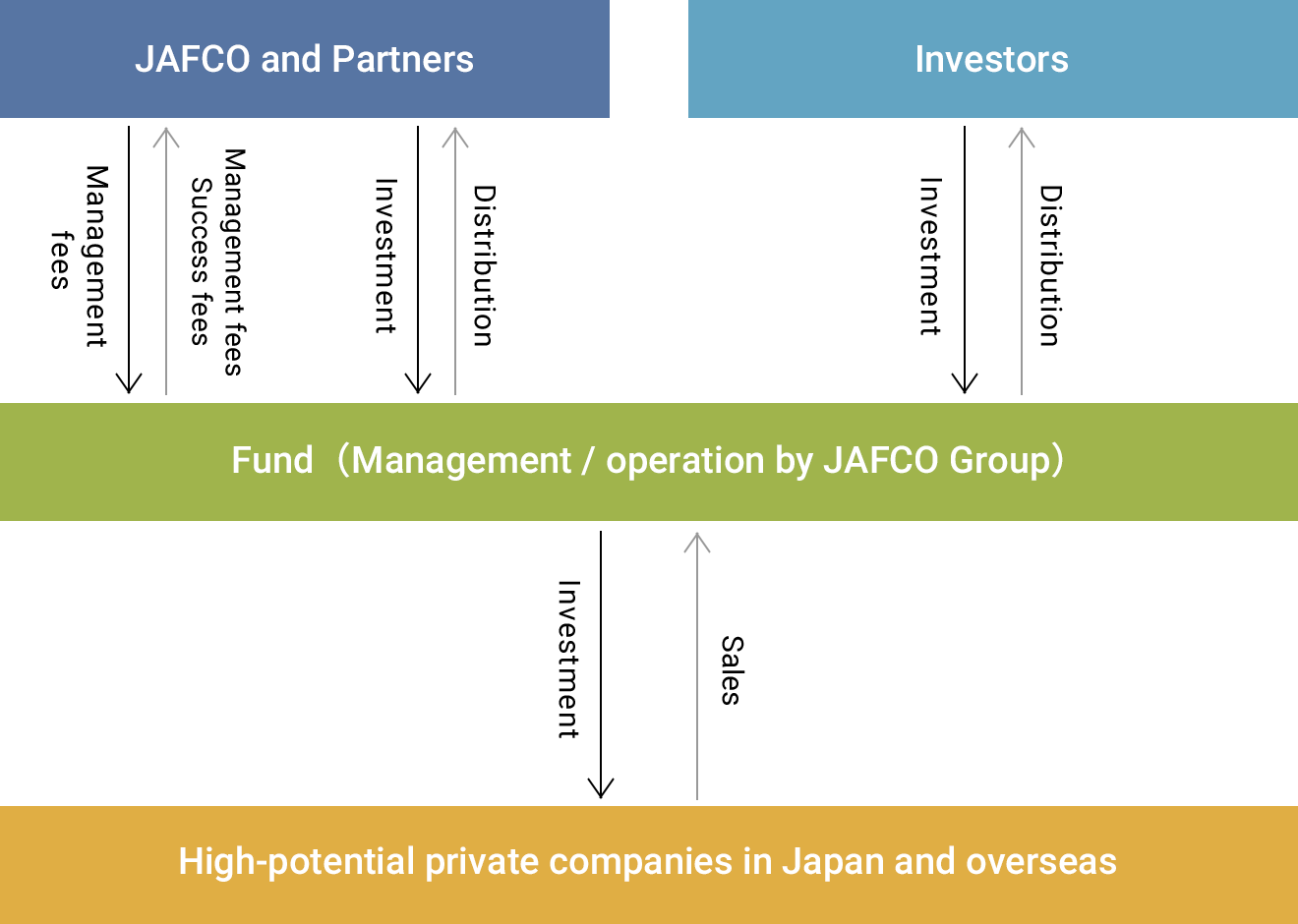

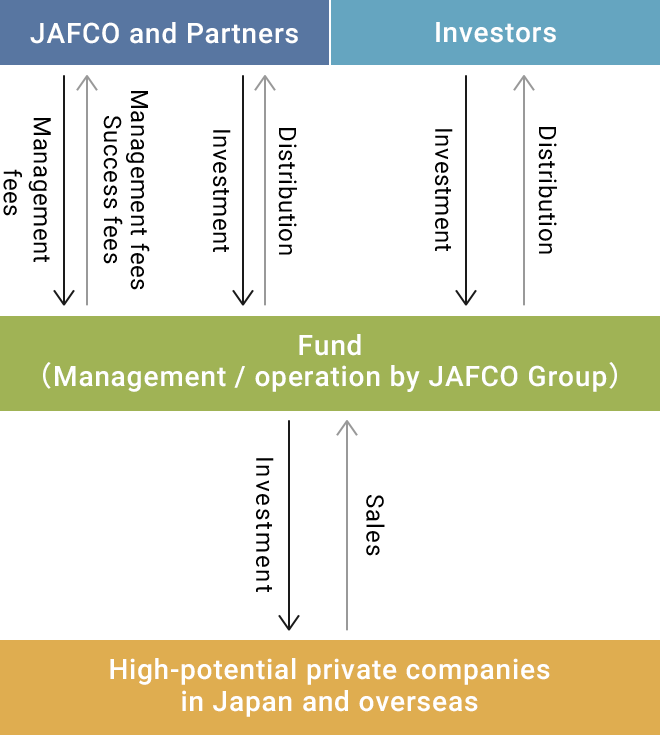

Business Model

We carry out venture investment and buyout investment through fund management. The main income sources are management fees and success fees derived from fund management and capital gains on direct investments in funds.

Investment structure

The investment team in each region (Japan, USA, Asia) manages funds separately. In each region, investment decisions are made locally and the investment team, deep-rooted in each community, carries out the whole process from identifying potential candidates to providing post-investment support.

As of April 1, 2025

Investment region: China, Taiwan, India, Southeast Asia

Investment team: 14

BD team: 1

Investment in growth regions, including China, Taiwan, India and Southeast Asia, by leveraging over 30 years of experience as a Japanese VC pioneer advancing into Asia

Investment region: Japan

Venture investment team: 44

Buyout investment team: 21

BD team: 16

Investment in ventures to create new businesses and buyout investment to obtain management rights and grow business using various strategies

Investment region: USA

Investment team: 6

Operating Partners: 2

BD team: 2

Participation in Series B/C rounds of promising ventures based on strong ties with top-tier VCs

Funds

We raise capital for funds from institutional investors and business firms about once every three years, and we invest a certain amount of our own capital in the funds alongside investors. Partners and employees also invest in funds as individual investors. As Japan's pioneer in venture capital fund management, we will preserve discipline and transparency under the following three management policies.

We do not establish industry-specific funds

We do not establish investor-specific funds

We only conduct fund management