Basic Views on Corporate Governance

JAFCO's basic views on corporate governance are as outlined below. With an eye to increasing corporate value over the medium to long term, JAFCO will make continuous efforts for its enhancement.

- Build respectful relationships with stakeholders

- Maintain transparency and fairness in decision making

- Establish an appropriate supervising structure

- Establish an operating structure that ensures effective and swift business execution

Corporate Governance Policy

Based on the above basic views, JAFCO has established the "Corporate Governance Policy" that outlines our concrete corporate governance measures.

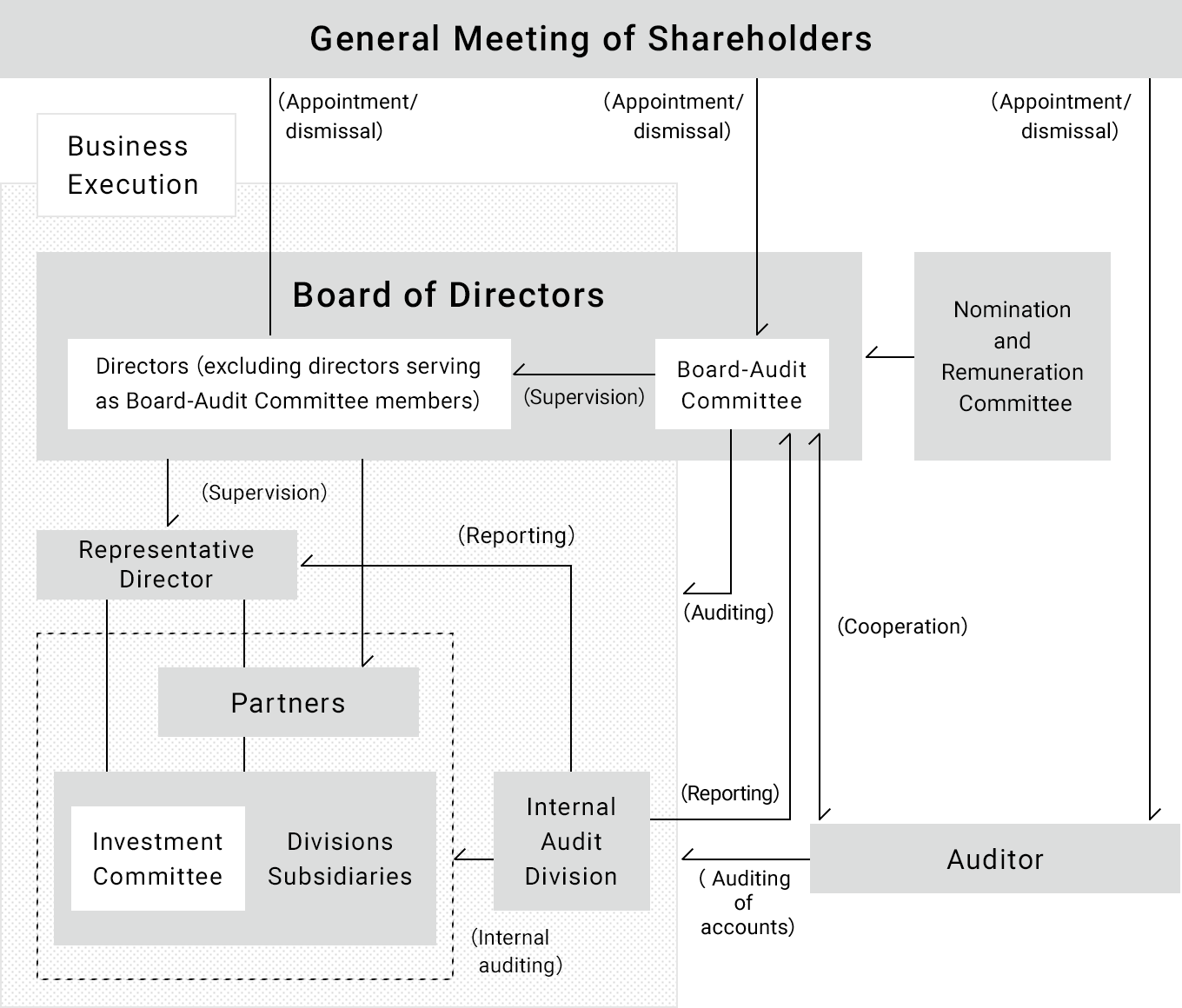

Corporate Governance Structure

Board of Directors/ Board-Audit Committee

JAFCO has adopted the "company with board-audit committee" structure for its corporate governance system.

JAFCO has established the Board of Directors and the Board-Audit Committee, through which it makes important management decisions and audits/ supervises business execution by directors.

Independent directors

In principle, a majority of the Board of Directors of JAFCO consists of independent directors to enhance the effectiveness of corporate governance. As members of the Board of Directors and/or the Board-Audit Committee, independent directors supervise management from a neutral and objective standpoint.

JAFCO shall select independent director candidates who have abundant experience and deep insight into corporate management or specialist fields, and can be expected to fulfill the roles and responsibilities of an independent director. The selection is in accordance with the "Standards for Independence of Independent Directors" of JAFCO.

Nomination and Remuneration Committee

The Nomination and Remuneration Committee has been established as a voluntary committee to perform functions of both of a nomination committee and a remuneration committee.

The Nomination and Remuneration Committee is composed of all independent directors and the President. The chairperson is selected from the committee members who are independent directors to ensure independence, objectivity and fairness. Currently, the Nomination and Remuneration Committee consists of four independent directors and the President.

The Nomination and Remuneration Committee carries out deliberations of important items related to the nomination (including succession planning) and remuneration of directors, corporate officers, partners and presidents of major subsidiaries prior to its presentation to the Board of Directors, based on the nomination policy in the Corporate Governance Policy and the policy on remuneration of directors, etc. The Board of Directors discusses and decides the relevant nomination and remuneration based on the deliberation at the Nomination and Remuneration Committee.

The Evaluation of the Effectiveness of the Board of Directors

The Board of Directors ("BOD") analyzes and evaluates its effectiveness and discloses a summary of the evaluation results every year. The summary of the results of the evaluation of the effectiveness of the BOD for the fiscal year ending March 31, 2025 is as follows.

The BOD evaluates its effectiveness on an annual basis. In the fiscal year ending March 31, 2025, the BOD held deliberations over items such as its composition, operation, role, responsibilities, etc. as in previous years based on questionnaires and interviews administered to all directors. As a result, the effectiveness of the BOD for the fiscal year ending March 31, 2025 has been confirmed as follows.

Composition of the BOD

In view of the supervisory functions of the BOD, it is deemed appropriate that the majority of the BOD consists of independent directors. Furthermore, the number of directors allows for substantial discussions considering JAFCO's scale. At the same time, there was the opinion that, while independent directors should continue to be the majority for further strengthening of the BOD's supervisory functions, there is room for further consideration of the composition of the BOD. Additionally, the experience and expertise required for enriching discussions are deemed to have been sufficient for the fiscal year ending March 31, 2025.

Operation of the BOD

A notable number of responses indicated improvements and progress in the quality and engagement of discussions compared to the previous year. The evaluations of information provision to external directors and support systems continued to be positive, particularly due to pre-meeting agenda explanations, but some independent directors pointed out issues regarding the provision of additional information and follow-ups on individual matters, identifying these as areas for future improvement.

Roles and Responsibilities of the BOD

Under the Basic Policy for Enhancing Corporate Value (the "Policy") formulated in December 2022, the BOD has been conducting supervision for organizing structures toward medium- to long-term goals and advancing operations through discussions on challenges and issues revealed during the deliberation of proposals and reports on business execution. Active deliberations have taken place at BOD meetings based on the diverse perspectives of each director. This year as well, the BOD has assessed that sufficient discussions have been conducted on certain themes.

During the fiscal year ending March 31, 2025, in order to enhance supervision of the establishment and management of internal control and risk management systems, the Harassment Prevention Policy was formulated and the internal reporting system was enhanced upon deliberation by the BOD. Going forward, the operational status of new systems will be monitored, with further improvements made as needed, and discussions on strengthening internal control will be continued on an ongoing basis.

Taking these factors into account, a comparison with the previous fiscal year indicates that the composition, operation, roles, and responsibilities of the BOD have generally remained the same or improved, demonstrating the overall effectiveness of the BOD.

Future Challenges

It was confirmed that continuous monitoring of the progress of medium- to long-term goals outlined in the Policy, conducted at appropriate intervals during BOD meetings, is necessary, coupled with constructive discussions, and that ongoing discussions from a medium- to long-term perspective is needed to delve into various issues related to enhancing corporate value and matters requiring deliberation.

We will continue to conduct regular evaluations to further increase the effectiveness of the BOD.

(updated as of Mar. 14, 2025)

Investment Committee

The Investment Committee composed of the President and partners, etc. has an authority to make investment decisions to allow quick decision-making. Directors serving as Board-Audit Committee members also participate in the Investment Committee on an as-needed basis.

External Auditor

JAFCO has appointed Ernst & Young ShinNihon LLC as its external auditor.

Internal Audit

The Internal Audit Division, independent from other business operations, audits overall business activities. The Internal Audit Division reports internal audit results to the President and the Board-Audit Committee.

Cooperation among Board-Audit Committee, External Auditor and Internal Audit Division

The Board-Audit Committee holds regular discussions with the Internal Audit Division and External Auditor to exchange information and opinions.

The Board-Audit Committee conducts audits based on internal audit results when available. The Internal Audit Division conducts internal audits at the request of the Board-Audit Committee and reports the result to the Committee.

Nomination and Remuneration of Directors, etc.

Nomination of Directors, etc.

- Directors and corporate officers are appointed by the Board of Directors after deliberations by the Nomination and Remuneration Committee.

- All directors (excluding directors serving as Board-Audit Committee members) are subject to election/re-election every year at the General Meeting of Shareholders. The Board-Audit Committee expresses its opinion on directors' election/ dismissal at the General Meeting of Shareholders when it deems it necessary.

- JAFCO shall select director candidates who have business skills, insight, experience, and expertise to serve as a director to allow the Board of Directors to fully exercise its operational and supervisory functions. JAFCO proactively selects suitable candidates from diverse background regardless of gender and nationality.

- In a case where a director has caused JAFCO to incur a tremendous loss or operational problems by committing a wrongful act, or violating laws, regulations, the Articles of Incorporation or JAFCO's internal rules, or has become difficult to execute duties by other reasons, such director shall be subject to dismissal proposal.

- A Partner is nominated with consensus of all partners and appointed upon the approval of the Board of Directors after deliberations by the Nomination and Remuneration Committee.

Reasons for the appointment and nomination regarding each director are described in the Notice of Convocation of the Annual General Meeting of Shareholders.

General Meeting of Shareholders

Remuneration of Directors, etc.

- The remuneration of directors (excluding directors serving as Board-Audit Committee members), corporate officers and partners shall be decided by the Board of Directors after deliberations by the Nomination and Remuneration Committee. The decision takes into account JAFCO's business results, fund performance, and the degree of individual contribution.

-

Monetary compensation for directors (excluding directors serving as Board-Audit Committee members), corporate officers and partners shall consist of basic compensation and extraordinary compensation. Part of basic compensation for directors is linked to the Company's ordinary income and other business performance, and extraordinary compensation additionally takes into account fund performance.

-

In addition, from the perspective of improving the Company's corporate value in the medium to long term, stock-based remuneration shall be paid to directors (excluding Board-Audit Committee members and independent directors).

-

The remuneration of directors serving as Board-Audit Committee members consists only of basic compensation excluding performance-linked portion, and there is no extraordinary compensation nor stock-based remuneration. The remuneration system, which is not easily affected by the Company's performance, ensures their independence to the Company's management.

- The Board-Audit Committee expresses its opinion on directors' remuneration at the General Meeting of Shareholders when it deems it necessary.

Disclosure and Constructive Dialogue with Shareholders

Information Disclosure

JAFCO shall make timely and appropriate information disclosures in compliance with laws and regulations, including the Companies Act, Financial Instruments and Exchange Act, and Timely Disclosure Rule of the Tokyo Stock Exchange.

In addition to the above, JAFCO shall actively provide information that is deemed essential or useful to understand about JAFCO

(except for personal information, customer information and information that may violate the rights of others).

JAFCO ensures fair disclosure of information.

Constructive Dialogue with Shareholders

JAFCO has established the policy for constructive dialogue with shareholders as shown below.

Compliance

Basic approach

Based on the recognition that not only compliance with laws and regulations but also taking appropriate actions in line with social norms is a prerequisite for all corporate activities, directors, corporate officers, and partners of the Company Group (as well as personnel with equivalent duties) shall lead efforts to ensure thorough compliance by the Company Group from a groupwide perspective. A compliance officer designated by the President shall supervise overall initiatives for the Company Group's compliance.

The Company has established basic principles regarding our engagement with compliance and created compliance regulations with the aim of ensuring thorough compliance within the organization. Based on these regulations, we have developed structures and initiatives to actively promote compliance.

Additionally, the Internal Audit Division audits and reports the status of the Company Group's compliance with laws and regulations to the President, the Board-Audit Committee, and, as necessary, the Board of Directors. The audited departments and subsidiaries shall promptly address any issues that need to be corrected or improved.

An internal reporting hotline has been established and is operated as a means for officers, employees, and others at the Company Group to directly provide information to the Company regarding conduct that is in violation of, or risks violating, laws and regulations.

Efforts to Prevent Harassment

The Company believes that fostering mutual respect for human rights and dignity and striving to eliminate discrimination and harassment from society with all connected parties, including directors, officers, employees, members of portfolio companies and investment candidates, clients, and business partners, is essential for achieving sustainable corporate growth and fulfilling its social responsibility.

Harassment is an unacceptable act that unjustly harms the dignity and character of an individual. Not only does it disrupt workplace order and environment, impairing work performance, but it also damages the social reputation of the Company and may hamper the development of the private equity industry. In the context of investment in unlisted securities, which forms the core of the Company's business, the relationship between investor and investee may give rise to power imbalances. Harassment in the workplace as well as harassment towards members of portfolio companies and candidates for investment fundamentally undermine trust in our business and are completely unacceptable. As a responsible business entity, the Company is committed to establishing a work environment where each individual is respected, can work safely, and can fully express their enthusiasm and abilities, and it will uphold the human rights of all associated stakeholders, conducting business with high ethical standards.

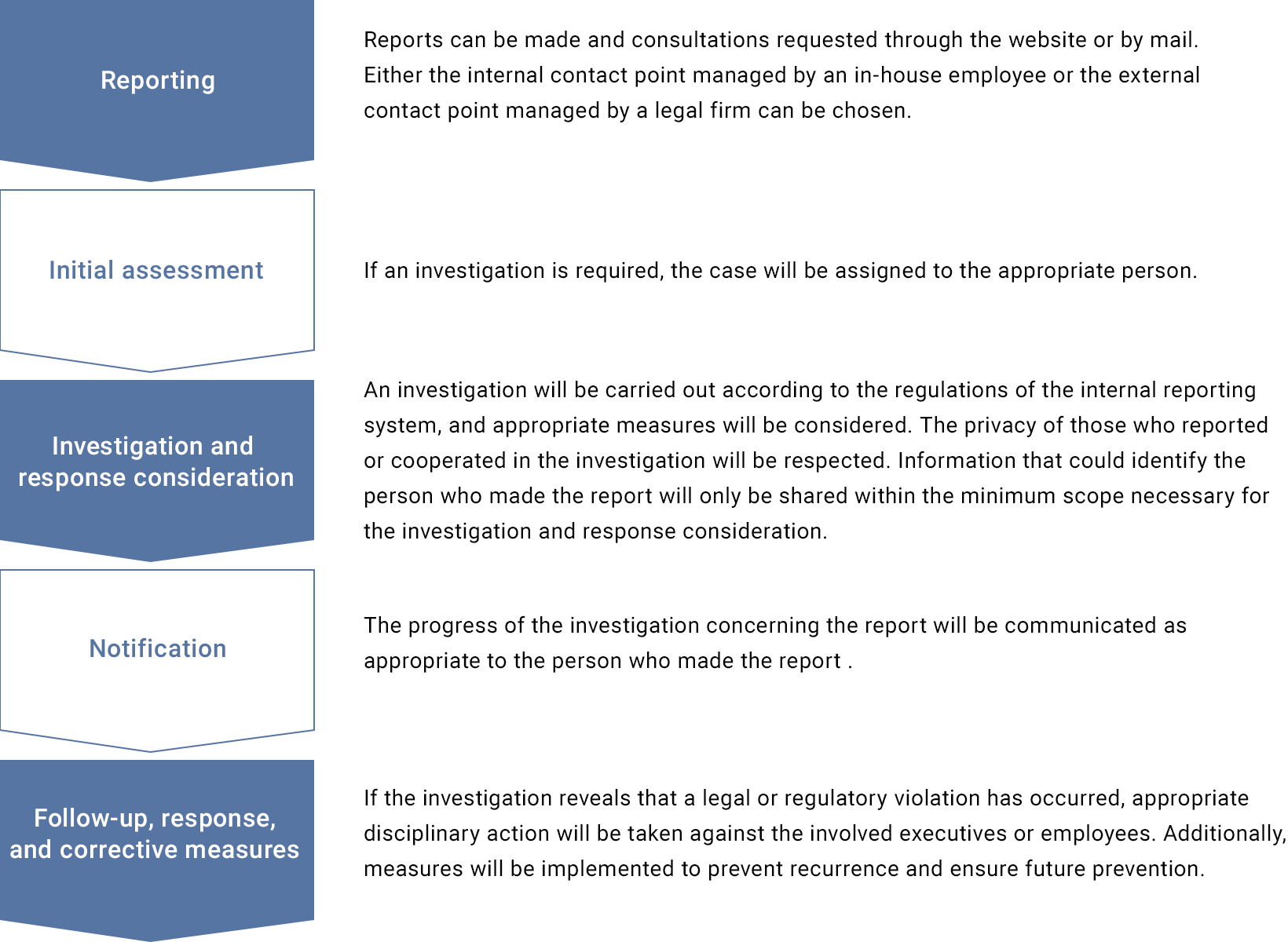

System for Reporting Legal Violations, Human Rights Violations Including Harassment

The Company aims to identify and address compliance issues and human rights violations at an early stage.

All of the Company's stakeholders, including its executives and employees (including contract employees, dispatched employees, etc.), former executives and employees, prospective employees, members of portfolio companies, investment candidates, clients, and business partners, may use the Company's reporting system to report or seek consultation if they become aware of any actions by the Company's executives or employees that violate or may violate laws and regulations, or if they have experienced or become aware of harassment by the Company's executives of employees.

The reporting system has two points of contact, one internal managed by an in-house employee and one external managed by a legal firm.

Confidentiality and the protection of the privacy of those who report are strictly upheld, and retaliation or any unfavorable treatment against those who report are prohibited.

If following an investigation it is determined that there has been a legal violation, human rights violation, or harassment, disciplinary action and corrective measures will be taken, along with efforts to prevent recurrence.

Operating Process of the Reporting System

Contact Points

When making a report, please be sure to review the Notes on Using the Incident Reporting System

Reporting by e-mail

Reporting by written document (mail)

Incident Reporting Hotline, JAFCO Group Co., Ltd.

Toranomon Hills Mori Tower 24F 1-23-1 Toranomon, Minato-ku, Tokyo 105-6324

JAFCO Group Incident Reporting Hotline, Ayako Ito, Miyakezaka Sogo Law Offices

Hibiya Chunichi Building 6F 2-1-4 Uchisaiwaicho, Chiyoda-ku, Tokyo 100-0011

Initiatives for Preventing Misconduct

Initiatives to Prevent Bribery

In response to the global trend in the establishment and strengthening of bribery prevention systems, we have established the Basic Policy on Bribery Prevention to address prevention of improper transactions. We ask our business partners for their understanding and cooperation.

Initiatives to Prevent Improper Use of Public Funds

Clarification of the Responsibility System

We have established the necessary matters with regard to the handling of public research funds, etc. in accordance with the Guidelines for Managing and Auditing Public Research Funds at Research Institutions (implementation standards) to ensure their proper management and promote appropriate and smooth operation. Under the President as the chief administrative officer, the Director in charge has been appointed as the supervising officer and the Manager of the department handling competitive funds, etc. as the officer responsible for compliance promotion.

Consultation and Contact Desks

We have established the following consultation and contact desks for the purpose of appropriate use of public research funds etc. (Japanese only)