Our Stance

Commit to New Business Creation and Jointly Shape the Future

We fully grasp the challenges the entrepreneur faces

and commit to support you in new business creation

Venture Investment

We provide stage appropriate risk capital to innovative and creative,

high-potential companies, and assist in value creation through

our support to the management team and for business expansion .

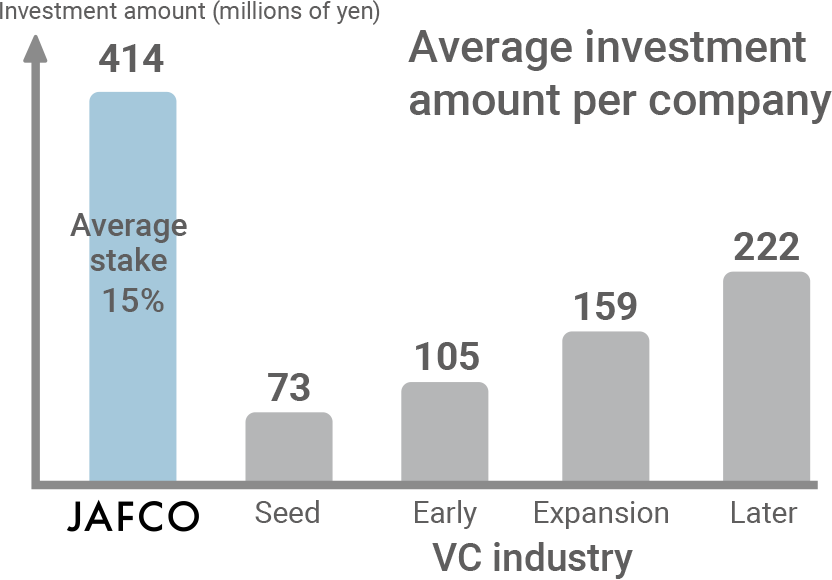

- Large scale

- We invest in several hundred million yen increments mainly in seed and early stage companies

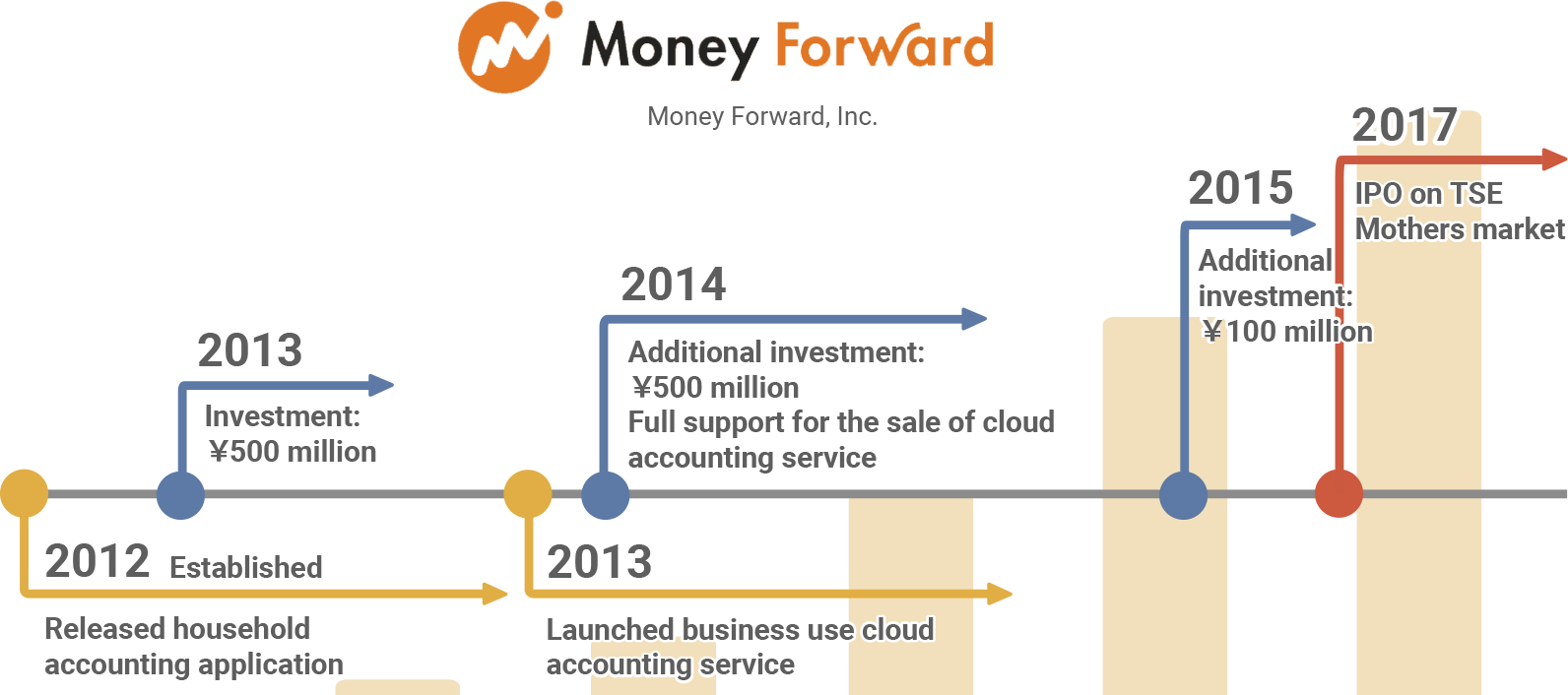

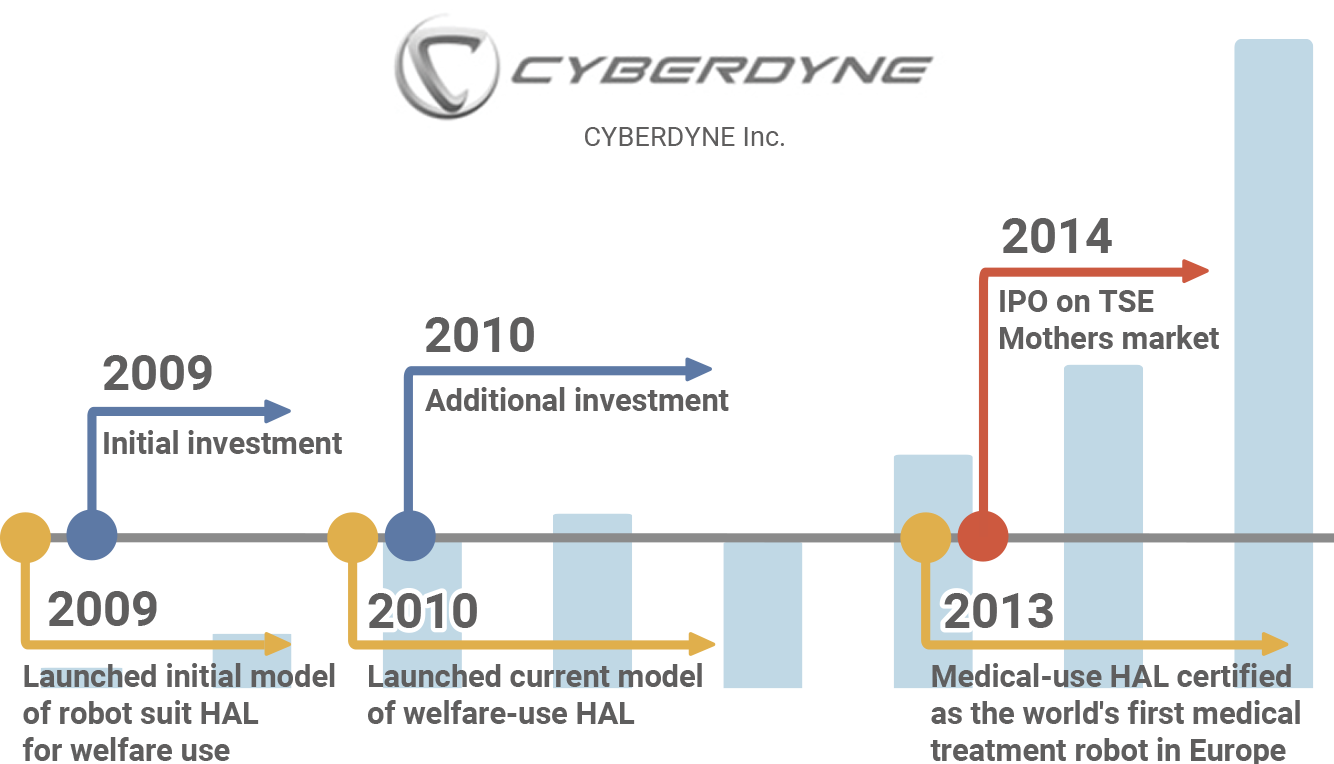

- Continuous

- We make follow-on investments to continuously invest in high potential companies

- Business creation

- Given that technological innovations will continue to disrupt industries, we invest in businesses that will create the next generation wave of innovation

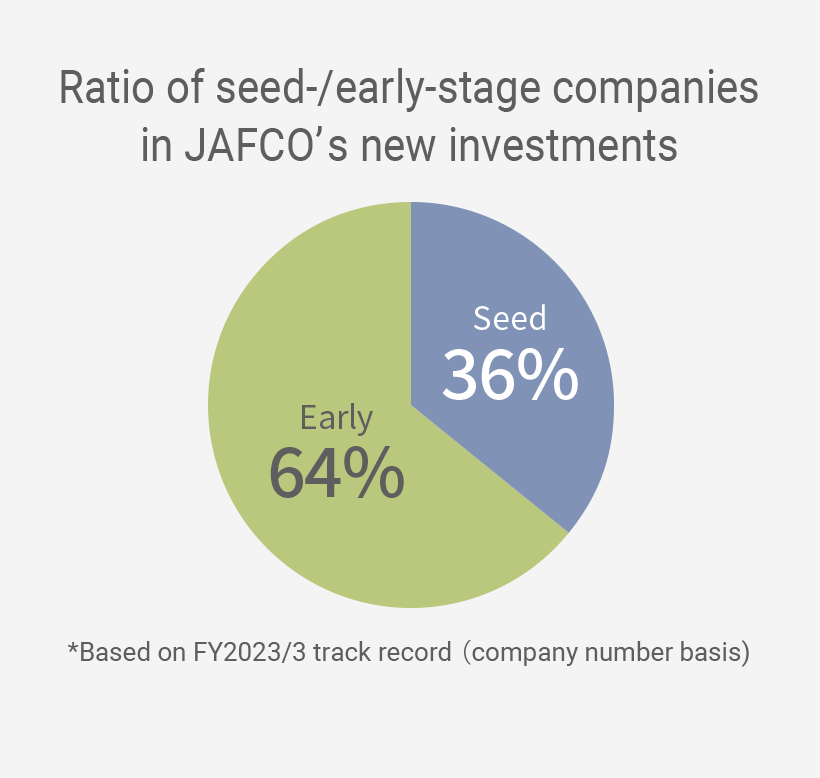

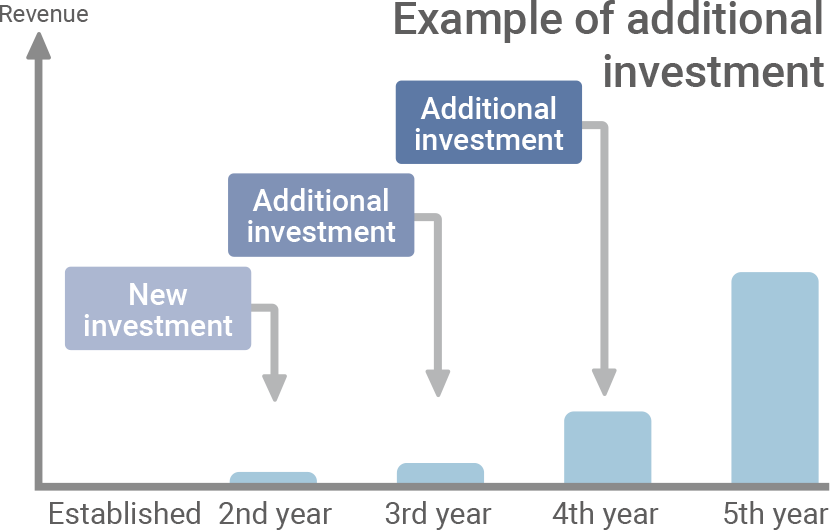

New investments are in seed-early-stage companies with high growth potential.

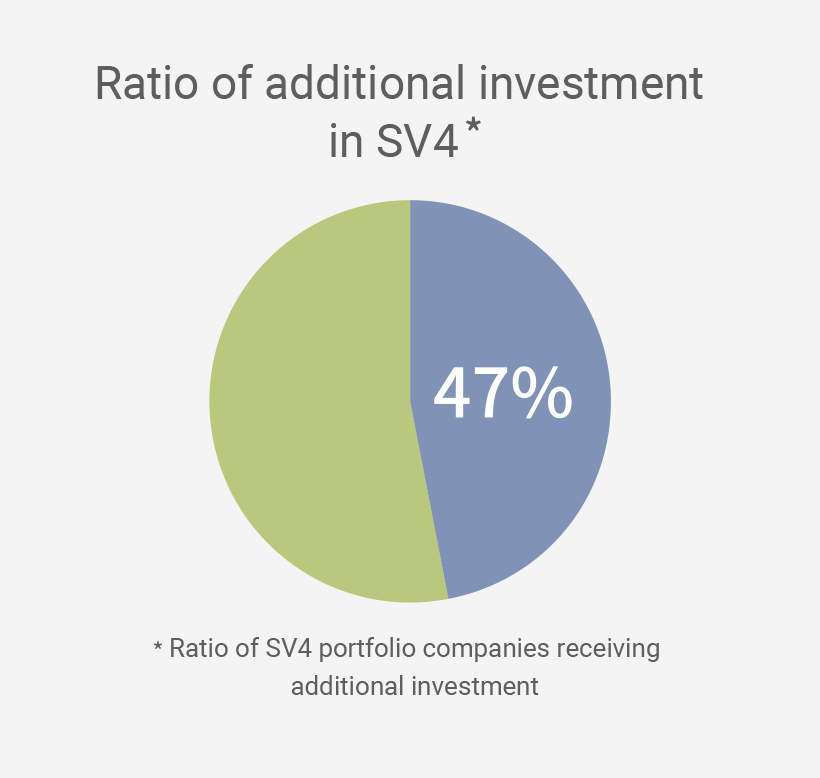

In addition to the first round,

we also make investment in additional rounds as needed

for the growth of portfolio companies.

The ratio of portfolio companies receiving additional investment stands at 47%.

*JAFCO's figure is based on new investments made in FY2023/3

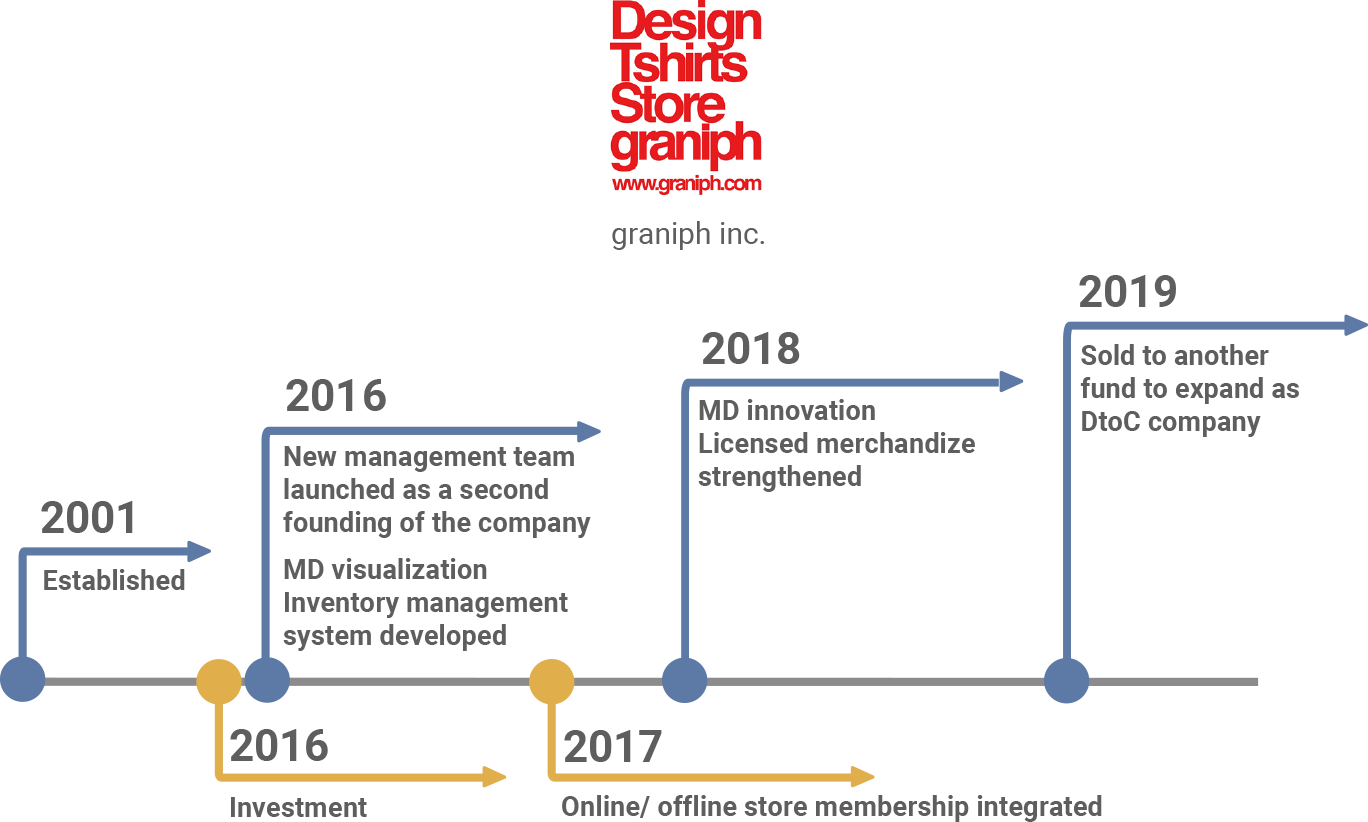

Buyout Investment

Based on our venture capital DNA and our commitment to supporting

growth, we work with management teams through various deals to help

them achieve capital independence and business expansion .

- Experience

- We identify promising businesses for investment leveraging our extensive venture investment experience

- Business Transformation

- We deploy cutting-edge technology to support business transformation and growth

- Respect

- We place great emphasis on building trust and respecting the corporate culture of each of our portfolio companies