In 'IPO Story,' we delve into the encounters between entrepreneurs and JAFCO and unravel their journeys. Entrepreneurs share their experiences, insights, and future prospects, now ready to be unveiled. In this edition, we present a dialogue between Tsunegoro Nishino, CEO of MRSO Inc., which went public on the Tokyo Stock Exchange Growth Market in December 2023, and Tomoko Numata, JAFCO's Chief Capitalist in charge.

【Profile】

Tsunegoro Nishino, Chief Executive Officer, MRSO Inc.

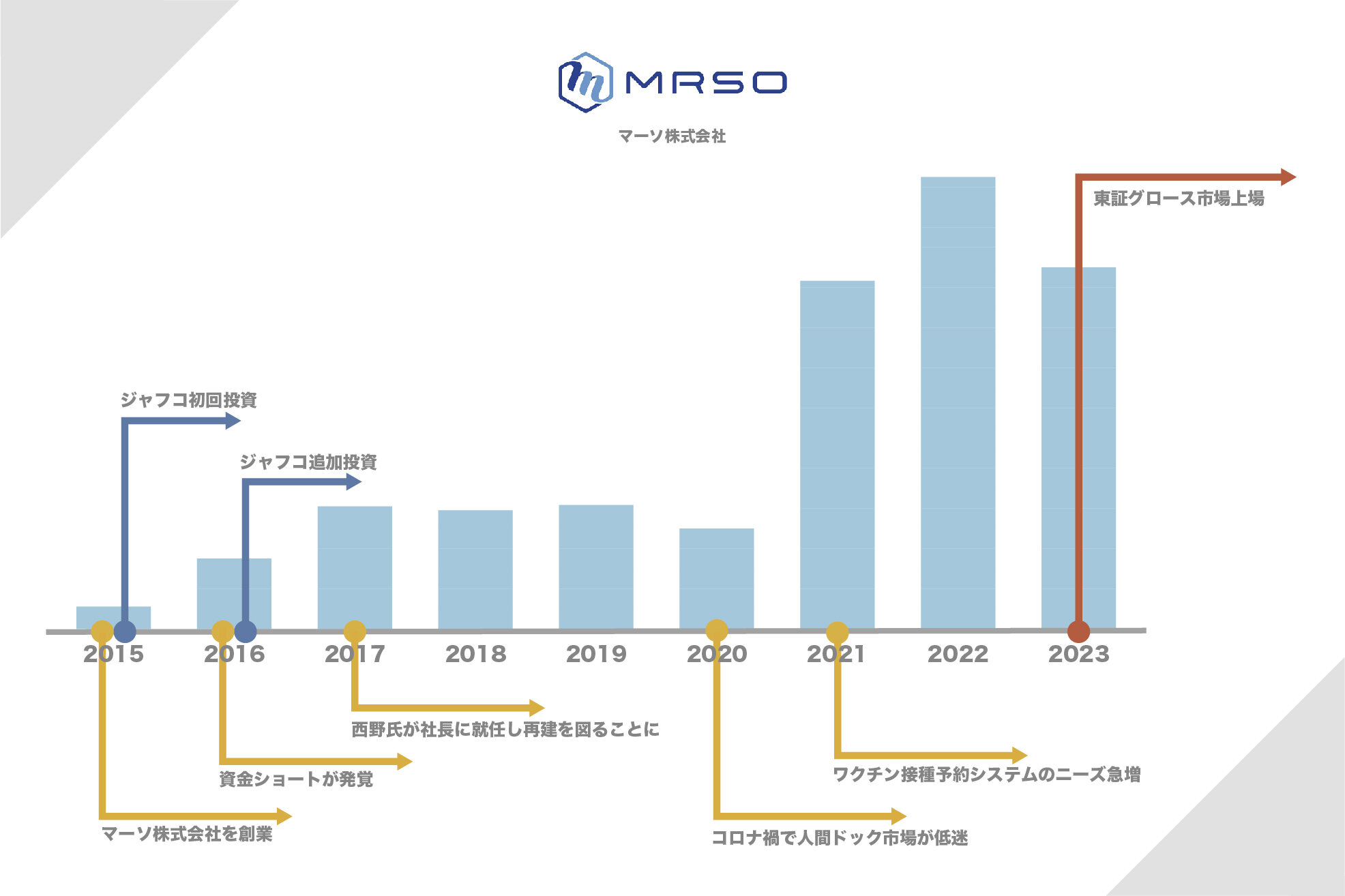

Mr. Nishino founded a business while in university and later served as vice president at a management consulting company. In 2004, he joined Sanwa Systems Co., Ltd. where he launched the Tokyo office and worked on the digital transformation (DX) of golf course management. He successfully grew Sanwa Systems into the largest domestic golf course DX company, becoming the company's president in 2011. In 2015, he spun off the healthcare DX division from Sanwa Systems to co-found MRSO Inc., where he assumed the position of chairman before becoming CEO in 2017.

【About MRSO Inc.】

MRSO operates the largest domestic preventive healthcare platform, MRSO.jp, which allows users to search for over 9,000 comprehensive health checkups nationwide based on individual preferences. It also provides vertical SaaS solutions for healthcare, government, and corporate entities. Particularly noteworthy is the administrative DX service, with a track record of implementation in over 600 municipalities, including services for resident health checkups and vaccine appointments.

Addressing the challenge of the nine to 12 year gap between the average lifespan and healthy lifespan of the Japanese population, MRSO Inc. aims to extend the healthy lifespan by eight years through its unique business of preventive healthcare and technology. The company went public on the Tokyo Stock Exchange Growth Market in December 2023.

Trust built over six years of regular meetings

Numata Mr. Nishino and I first met in 2009. At that time, I heard about the rapid growth of Sanwa Systems, a company specializing in golf course DX in the Ibaraki area I was in charge of. It all began when I visited Mr. Nishino's father, who was the president at that time. He suggested that I go meet his son at the Tokyo office who is doing various things.

Nishino I was originally a student entrepreneur and served as vice president at a management consulting company I founded during my university days. However, I joined my father's company in 2004 and started handling business in Tokyo. At that time, the golf course industry was undergoing significant restructuring, and I had authority beyond the president to be able to rebuild our family business. It was around that time that I met Ms. Numata.

Numata I remember being overwhelmed by Mr. Nishino's energetic presence. It made sense of the rapid growth of Sanwa Systems, and it made me want to invest in his endeavors someday. However, Mr. Nishino didn't have the intention of taking Sanwa Systems public.

Nishino Since my university days, I had been involved with various business leaders, and I didn't necessarily feel the need to aim for an IPO. Even though we were not publicly listed, our performance was growing, our customers were satisfied, and we could take good care of our employees. At that time, as a business leader I was confident that it was sufficient.

Nevertheless, Ms. Numata visited me every three to four months, providing valuable information. As a business leader, you usually have to go and gather information yourself, so I was grateful to receive regular updates. Ms. Numata herself had a high growth ambition and was aggressive, so it was a positive influence on me and it was a meaningful time.

Numata Even if Sanwa Systems didn't go public, I believed there was a possibility of spinning off new businesses and aiming for an IPO. That's why I was excited when I heard that you established MRSO by spinning off the healthcare DX business in 2015. Could you please share the background of the change in your thinking about not necessarily aiming for an IPO?

Nishino After Sanwa Systems became the largest domestic player in golf course DX, I felt it would be challenging for me as a business leader to significantly expand the company further. Therefore, I decided to take on the role of nurturing young executives and established MRSO, appointing a friend as the president. It was then that the option of an IPO first came to my mind.

I considered going public to enhance social credibility. To achieve that, I wanted investment from JAFCO, Japan's largest VC firm. After the initial investment from JAFCO, I felt a sudden increase in social credibility, though I had expected it. Additionally, I thought that it would be ideal if Ms. Numata, with whom I had a valuable relationship for six years, could be involved.

When I shared this with Ms. Numata, she immediately responded, saying she would definitely invest. From there, it took about a month of swift deliberation within JAFCO to reach a decision.

Numata I was attracted not only to Mr. Nishino's credibility as a business leader but also to the future potential of the business as a reservation site for comprehensive health checkups. Private medical services are easier to monetize compared to insurance-based services, and proposals to maximize revenue are more appealing. In the case of MRSO, the system allows for easy expansion by simply placing banners on the websites of medical institutions to gather reservations. Furthermore, there is the potential to leverage accumulated healthcare data from checkups in the future. Considering the expertise developed in golf course DX, I saw it as a business where we could maximize its value and ultimately decided to invest.

An unexpected organizational crisis and the difficult decision to postpone the IPO

Numata I accompanied MRSO as a partner until it achieved its IPO in December 2023, and there were undoubtedly challenging moments. Mr. Nishino, were there any difficult experiences that left a lasting impression on you?

Nishino The funding shortage in 2016 comes to mind. At that time, I was an external director, and I delegated financial and accounting matters to the management team. However, it turned out that what being reported to me differed significantly from the actual financial situation. We were about to acquire a BPO business, but the funds for the purchase were insufficient. I had deliberately refrained from touching the money since JAFCO became the leading shareholder to make it clear that the management authority lay with the management team and not me. This, unfortunately, backfired, but, fortunately, JAFCO promptly decided to make additional investments, and we were able to overcome the crisis.

At that time, our back office was not functioning adequately, so with the assistance of Ms. Numata and everyone at JAFCO, we spent about six months reconstructing the back office, including a thorough examination of the accounting. I took responsibility for the top line and cost control, and from 2017, I directly oversaw management as the president. Our business revenue was not declining, so I am truly grateful that they carefully assessed the situation and provided additional investment.

Numata Looking back on the events of that time, what lessons did you learn as a business leader?

Nishino At that time, I was completely complacent about my success in Sanwa Systems, which was growing rapidly. I think I hadn't fully understood the difference between managing the business myself and entrusting the management to someone else as the president. I learned to always have the perspective that unexpected events could occur, and I became more cautious in my management.

Numata After rebuilding the management, you achieved a V-shaped recovery in 2017 and 2018. However, in 2018, you made the decision to postpone the IPO originally planned for that year.

Nishino About a year and a half had passed since the change in presidency, and while constantly needing to meet the performance forecasts promised to investors, I concluded that it was premature to go public. However, there were many opposing opinions internally, leading to a significant number of resignations from the management department involved in the IPO. This forced us to rebuild the organization once again, and we received various criticisms from external sources.

Even though we were delivering results on the business front, deciding to postpone the IPO led to several situations where I, as a business leader, felt negated. I shared this sense of discomfort with Ms. Numata and she empathized with my feelings, regardless of any vested interests.

At that time I had a strong desire for Ms. Numata and JAFCO to ultimately think that it was a good investment for them. Thanks to Ms. Numata, I felt motivated to keep working hard until we could restart the IPO project.

Numata The business itself was growing, so there was a sense of trust that Mr. Nishino will somehow manage. Ultimately, we were able to start fresh with a reliable management team, including Mr. Abe, who was a director at Sanwa Systems and is now the vice president of MRSO. I believe it was a good decision for MRSO to have members who could carefully consider what was best for the company.

Overcoming the market downturn during the pandemic with vaccine appointment reservations

Numata Before the IPO, there was another challenging situation--the hardships of the COVID-19 pandemic. However, you managed to turn adversity into an opportunity, which truly impressed me.

Nishino The market for physical checkups cooled off due to people staying home during the pandemic, and sales declined. However, our performance has been steadily growing since the V-shaped recovery, and, thanks to investments from JAFCO, we had no cash flow issues. The last thing I want to do as a manager is to make my employees uneasy. Therefore, we decided to go through this "voluntary lockdown" period with a sense of giving everyone a break.

Since we had originally been providing a health checkup reservation system for local governments, we received offers for vaccine appointment reservation systems in the latter half of 2020. Engaging in a socially meaningful business boosted everyone's motivation. While our track record for health checkup systems for local governments stood at 100 municipalities before the pandemic, it expanded to encompass 600 municipalities. We also increased transactions with major companies and universities. Even though the market for physical checkups has recovered, we have reached a state where we can continue to grow our performance, even without the special demand for vaccine appointments.

Numata By swiftly launching the vaccine appointment reservation system, we not only compensated for the deficit but also recorded a significant profit. Furthermore, we were able to achieve stable growth beyond that.

Nishino The pandemic was a time that not only our company but society as a whole had to endure. We welcomed this period in good conditions, both in terms of performance and organization, so we didn't feel pessimistic at all.

Rather, for startups like us, times of transformation offer more opportunities than periods of low and stable growth. The major restructuring in the golf course industry that we faced during the Sanwa Systems era allowed us to significantly grow our company precisely because of that change. So even in the case of the pandemic, we had a sense from an early stage that it might become a tailwind.

Maximizing the potential of preventive healthcare

Nishino Despite the twists and turns, we were able to go public safely, and I feel relieved. Honestly, what were your thoughts, Ms. Numata? Did you think we could go public?

Numata As long as you didn't abandon the idea of going public, I believed it was possible. Given your personality, if there was even a tiny bit of uncertainty about the performance, there would be a possibility of not going public, but that didn't seem to be the case so I was confident that you would go public.

Nishino Compared to when we postponed the IPO in 2018, I was in a state where I could completely handle the management, so there was indeed no such anxiety. I also had the pride of not wanting to be seen as a CEO who couldn't go public [laughs]. However, if it weren't for Ms. Numata being in charge, I might have given up.

Numata I believe that even if you didn't go public, you would have found alternative ways to grow the company. What kind of initiatives do you plan to undertake now that you've gone public?

Nishino Through the promotion of preventive healthcare, we aim to extend the healthy life expectancy by eight years. Currently, over 90% of the healthcare market is focused on treatment, and prevention is not a hot market because it involves investment. However, considering Japan's population decline and the need to sustain inflation, the potential of preventive healthcare is significant. Our mission is to maximize that potential.

We will continue to promote reservation of physical examinations through "MRSO.jp," management of health checkups for major companies, and DX for medical institutions, and eventually, we are considering utilizing big data on sub-health conditions obtained through these businesses. We are looking to establish an ecosystem that enables continuous access to preventive medicine, not just after a medical checkups. This is the vision we would like to achieve in the future.

Numata Mr. Nishino, as someone who continues to take on challenges, could you share a message with other entrepreneurs?

Nishino I think Japan's prolonged economic stagnation is due to an increasing number of people fearing risks and becoming overly inclined towards stability. However, entrepreneurs themselves must create an era in which not taking risks becomes a risk. To achieve that, if you receive an investment offer from JAFCO, I hope you accept it without hesitation.

Before raising funds, I was overly cautious about VCs, but looking back, there was no need to be afraid, and I genuinely think it was beneficial. I feel so much value in having been able to take on this challenge with JAFCO that I would say that there's no point in launching a startup if you are not going to accept JAFCO's investment. I encourage everyone to take on risks with courage and without succumbing to fear.