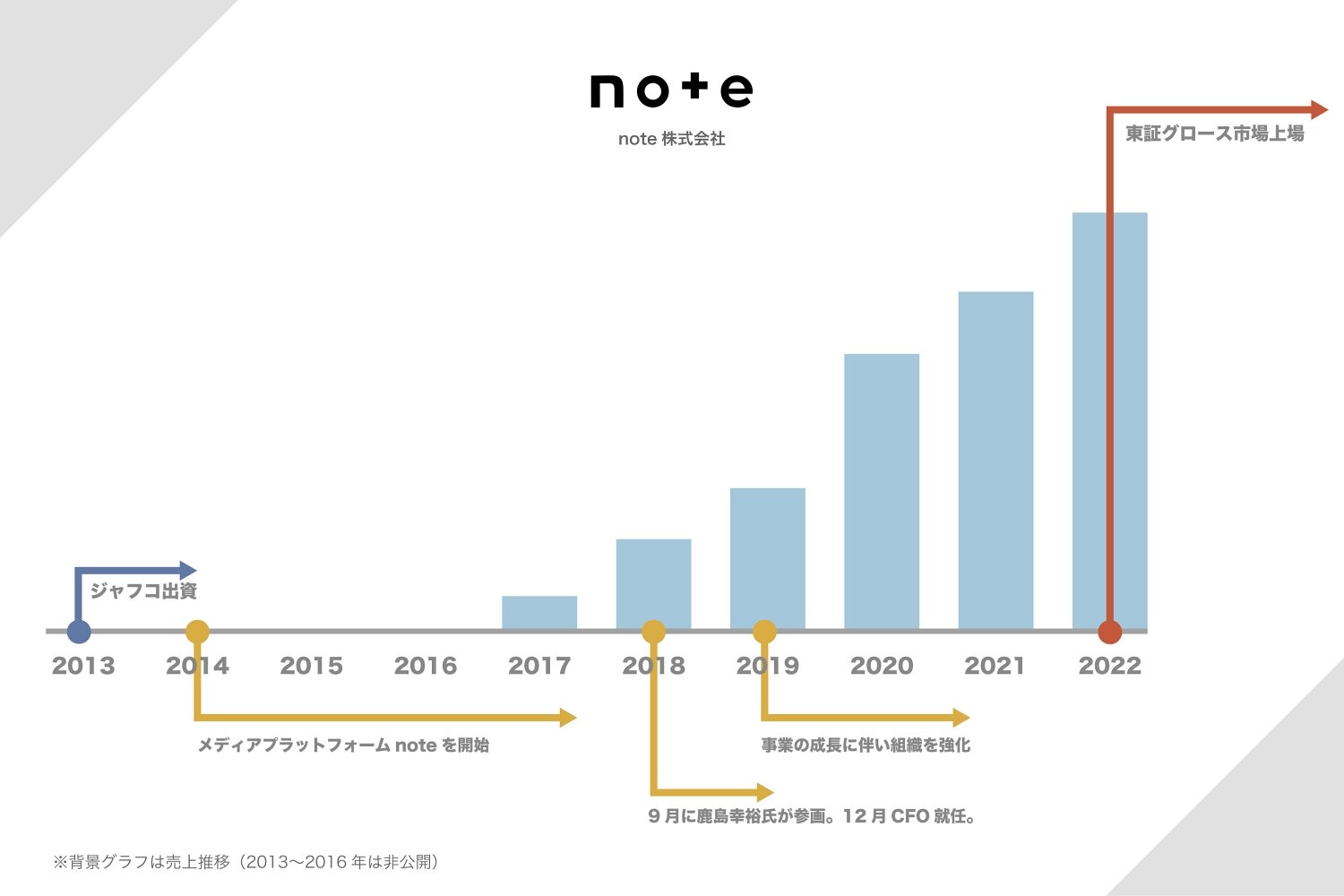

"IPO STORY" tells a story of JAFCO and its portfolio company from their encounter to the listing. This time, a dialogue between Yukihiro Kashima, CFO of note inc. who supported its IPO on the Tokyo Stock Exchange Growth Market in December 2022, and Yoshikazu Akagawa, who is in charge of note inc. now reveals episodes and thoughts behind the successful listing and tells about the future outlook of the company.

【profile】

Yukihiro Kashima, Director and CFO of note inc.

Born in Aichi Prefecture in 1983. Graduated from University of Tokyo in Faculty of Law and Stanford University with a MBA, he joined the Ministry of Foreign Affairs and a foreign strategy consulting company. He joined Tabelog Headquarters of Kakaku.com and served as a new business manager and company-wide corporate planning manager. He worked as CFO and CAO of a beauty salon company with a chain of over 100 salons nationwide and then joined note inc. in 2018. As CFO, he oversaw overall corporate affairs, focusing on strategy and finance. He raised funds in its several unlisted rounds, expanded the business and the organization, and realized the listing on the Tokyo Stock Exchange Growth Market in 2022.

[What's note inc.]

With the mission of "making it possible for anyone to start and continue creation", note inc. works on creating a system for expression and creation. They operate business centering on a C2C media platform "note," which allows anyone to freely post and sell content on the Internet, and a media SaaS "note pro" which allows easy and effective transmission of corporate information based on note. In December 2022, the company made IPO on the Tokyo Stock Exchange Growth Market.

I joined note inc. to create an organizational structure that supports its growth

Akagawa You joined note inc. in September 2018. Why did you choose the company? Could you tell us about your decision including your prior career?

Kashima I started my career at the Ministry of Foreign Affairs, and so my background was not in a financial field originally. The turning point was at the time when I went to Stanford University in the United States to study for an MBA for two years. Startups are very active there, and many people from established industries jump into a startup industry. I remember how I was impressed and felt "What an interesting trend there is in the world."

Akagawa From that point, you changed the course of your career to startups.

Kashima After a foreign strategy consulting company, I joined Kakaku.com and engaged in new business development and management planning, aiming to work on a business that "enriches people's lives with technology." Then, I worked as CFO of a beauty salon chain company which was invested by a private equity fund and I joined note inc.

I joined note inc. because I wanted to challenge the world of Internet startups where their service scale is growing fivefold, tenfold and more with the power of technology. And I also felt that I would like to be involved in a service which is used by many people close to me, such as my family members and friends once I was to do so. If each person spreads "creation" through note, a rich society will be created. I thought that being involved in a platform, "note" would be socially important and very attractive.

Akagawa When you joined note inc. it was an organization with about 30 members. I think there was a mountain of things to be done, such as team building and system development although you didn't have any person who was in charge of corporate matters. How did you share tasks with Mr. Kato, the Representative and what did you do?

Kashima Kato is a professional creator who has produced bestsellers as an editor. He is well-versed in creators and content, and has a keen sense of services. I totally trust in his judgement on products. Also, in addition to Kato, we have Fukatsu who is CXO and so we have a powerful team for product development and UI/UX.

Akagawa In fact, the service began to grow steadily around 2018.

Kashima That's right. Some early adopters started using it first, and then so-called general users, companies and individuals also started using it, sharply increasing the number of contents and our growth model began to work.

Then, the organizational structure that supports the rapid growth of services was required. The growth cannot be sustained without a strong organization that facilitates it. I joined note inc. in order to establish an organization that can sustainably grow as a listed company in the future, and to further grow the company and its services.

Akagawa Your ability was apparently expressed on your business plan and performance plan sheet. Although there were many variables, you interpreted their deeply entangled values and logics, and simply and accurately you compiled them on the business plan sheet, which really impressed me. I did appreciate the accurate and sophisticated way of your presentation.

I think it's because of your viewpoint brushed up through your career. What an excellent person joined the company! So thought I and I was convinced that it would become a good organization, taking into account your personality too.

Kashima Startups often handle highly innovative services which we have never seen before in the world, and their business grows discontinuously, so we have difficulty creating a rational business plan in many cases.

Under such circumstances I identified what core drivers of business growth were and which KPI would be important parameters, thinking adjusting perspectives of stakeholders inside and outside the company, including investors, would be the first step toward future growth. With the idea, I joined the company and worked on creating a business plan first. If you create a business first, you can deepen understanding of the business at once, and so I recommend it to all CFOs who participate in startups.

Building a strong team through uncompromising recruitment that values culture

Akagawa I feel that having you at management meetings makes very positive effects by sorting opinions out and bringing in an objective viewpoint. Do you have any issue you have found after joining the company through your experiences in various organizations?

Kashima I found that the corporate organization had yet to be improved just like an early-stage startup while its services were growing rapidly, so I felt we need to develop the corporate organization to catch up the services. When I joined the company, there were no specialists in human resources, legal affairs, corporate IT and others, and so I started doing everything by myself, from drafting a contract to procuring PCs.

When I joined the company, there were no specialists in human resources, legal affairs, corporate IT and others, and so I started doing everything by myself, from drafting a contract to procuring PCs.

Akagawa Now you have a team of highly skilled professionals. I had some discussions about hiring, but I believe that the team was born because of your high hiring standards.

Kashima I had a very strong desire to bring in good members. Our legal manager is a lawyer, and the finance manager is a certified public accountant. As for persons in charge of human resources, labor affairs, corporate IT, public relations, and others, we were able to hire well-experienced professionals in each field.

We wanted to hire necessary staff as soon as possible for a long time, but I was determined not to compromise. I believe if highly-skilled people join the company, even "better people" will come in, wishing "to work with this kind of skillful person." I wanted to cherish that kind of cycle.

The challenge was finding people who were not only highly skilled, but fitted the culture of the company. For example, there are many people who are certified public accountants, but it is another story whether they fit the culture and are able to demonstrate their performance well. As a result, for a quite long time, I was unable to hire anyone who could lead the Finance and Accounting team and had to hold the position concurrently. At the timing when we were about to get full-fledged screening for the IPO, we were able to build the current team with a clear division of roles.

Akagawa What kind of points did you have to see whether a person fits or not the culture of the company?

Kashima The major premise is that we are a start-up organization. So, it is important to have a mindset of "wanting to try new things" and "enjoying chaotic situations." On top of that, the company is based on the idea that its platform itself should value the atmosphere of the space and nurture its content without competing with others. Having no ranking is another characteristic of the company.

Since we are the company that creates such services, many of our members wish to cherish our good cooperative environment and create good services. I valued that culture fit.

Akagawa I see. When you joined the company, you were also a new member from outside and in the position to build the organization while valuing the original goodness of the company. What kind of relationship did you try to build with the existing members?

Kashima I believe that respect for the existing members who have grown the service is indispensable as a new member, no matter what phase you join. Also, since I was joining as the person in charge of corporate affairs, I had to convince people that the organization is improved since I joined.

When relocating offices and designing systems, I was careful to create an infrastructure that would allow employees to work comfortably and maximize their performance.

The difficult thing is that it sometimes leads to "tightness" which requires employees to submit applications and get approvals by rules set in the process of building an infrastructure. These systems are necessary for the organization in the process of expansion, but they must be introduced in a way not to detract the goodness of the startup.

I tried to customize and design such systems that would be beneficial for the members, for example, "a system which helps more rational decision-making and leads to a long-term growth."

Most appealing part of JAFCO is its various advices based on the investment track record.

Akagawa I guess, in the process of realizing the IPO, you had a lot of difficulties unique to the company because of its novelty.

Kashima That's right. There are not many services similar to ours not only in Japan, but also in the world, so I can say it is a very unique service. Senior managers told me that in the case of highly novel businesses and services, in general, there would be more checking items in the listing because there were few precedents.

Note is a new service that allows anyone to post and sell his/her own content, different from the existing business models including media that make money from advertising. The number of contents currently exceeds 30 million (as of the end of November 2022), and there is no other platform with such a huge volume of content.

In the first place, with what kind of incentives do people post? For what purpose do content buyers decide to purchase? How do you guarantee the quality of the huge vollume of content? I had to prepare answers to various questions.

Akagawa More the novelty and complexity of the service increase, more issues need to be sorted out. For JAFCO, we shared the expected obstacles based on the precedents of already listed companies with highly novel business content.

Kashima That support really helped me. I believe that JAFCO's strength lies in this.

On the startup side, IPO preparation itself is the first experience, so we had no knowledge. Based on JAFCO's extensive investment track record and the know-hows you have acquired from experiences, you led us adequately, proposing "Let's deal with it this way in this case." I also had opportunities to hear from people who actually experienced or were involved in IPO.

Akagawa That's right. I asked entrepreneurs and management members who had engaged in highly novel services about what kind of team they were in, what they prepared for the assessment, how they solved the issues, and so on.

Kashima Until I actually started contacting you, I had only a vague image of JAFCO as a "long-established company." Now, I realize that JAFCO's "trustfulness" comes from abundant of resources and networks it has cultivated through various cases.

IPO is just a step forward, making note an infrastructure-like existence that everyone uses

Akagawa The market environment was not good for IPO scheduled in December 2022 and we had a lot of discussions. Even then, the long-term goal of achieving the mission was clear.

Kashima That's right. We consulted you many times whether we should wait until the environment improved and go public a few years later. But if we focus on our mission, it is essential to grow quickly as a listed company.

Looking back in 10 or 20 years from then, I thought it would be just a small error whether the market environment was good or bad at the time of listing. We told you that the achievement of our mission would be delayed if we postponed the listing and you gave us a supportive push.

Akagawa I thought it was true that "it would be just a small error, looked back in 10 or 20 years" and I was convinced that there was no point in postponing it. As an investor, I thought it was important to respect the will of the management of the company to create a new infrastructure. From now on, how do you want to grow the company? What kind of future are you imaging?

Kashima The IPO is just a step forward. The mission of the company is to "make it possible for anyone to start and continue creation." And, the goal of the note platform is to become an infrastructure-like existence that everyone can use.

Thankfully, many people use note today, but I think there are still many people who do not know it yet if you ask whether it has truly become an infrastructure that everyone can use.

In that sense, we haven't reached even 10% of our mission achievement now. We believe that we need to increase the flexibility of fundraising, our social trust, and the level of our recognition in order to make note an infrastructure for people's daily creation and moreover for their lives.

Akagawa I hope the company will make even greater strides after IPO. Lastly, please give a message to those who are wondering whether they should build their career and take on a challenge to join a startup management.

Kashima What I really feel from my experiences with startups and IPO is that the experiences which link the things I did and the decisions I made directly to the growth of the company is very rewarding, exciting, and interesting.

Now, startup entrepreneurs and individuals who work for startups are publishing a lot of information through "note," making it easier to imagine working for a startup. If you want to be involved in a rapidly growing service, grow the business by yourself, or achieve something big by taking on new and difficult business challenges, there are many opportunities open to you to make the most of your skills.

I started my career in a large organization, and if more people from large companies or professional firms jump into startups, I think a good ecosystem will be created. I hope this trend will continue to grow further.

Comment from the person in charge: Yoshikazu Akagawa

In April 2013, JAFCO made a Series A investment in note inc. (Piece of Cake then). I remember that I was attracted to President Kato's background, business concept, and market potential. Since SNS became a social culture, the recognition of the company has gradually spread, and the efforts of those who have already worked for it and the participation of professionals in various fields, including Mr. Kashima, realized IPO in December 2022. Their business is evolving day by day. I believe that their service, note will make even greater strides toward the goal of being an infrastructure-like existence that everyone can use.

In April 2013, JAFCO made a Series A investment in note inc. (Piece of Cake then). I remember that I was attracted to President Kato's background, business concept, and market potential. Since SNS became a social culture, the recognition of the company has gradually spread, and the efforts of those who have already worked for it and the participation of professionals in various fields, including Mr. Kashima, realized IPO in December 2022. Their business is evolving day by day. I believe that their service, note will make even greater strides toward the goal of being an infrastructure-like existence that everyone can use.