"Entrepreneurial aspirations" to hear the background of deciding to start a business, the conflict until the business gets on track, and the desire to realize through the business.

In the 5th session, Biopalette Co., Bio Palette Co., Ltd, which has the technology to "edit" the genome without cutting DNA, and Synplogen Co., Ltd., which has the technology to "synthesize" DNA by "long-chain DNA synthesis technology", both "DNA". We interviewed Mr. Kazuhiko Yamamoto, a director of two companies that carry out business centered on.

【profile】

Kazuhiko Yamamoto, Director of Bio Palette Co., Ltd, Synplogen Co., Ltd.

After graduating from the Department of Business Administration, Faculty of Commerce, Hitotsubashi University in 1988, after working at Sumitomo Electric Industry Co., Ltd., Nomura Research Institute, Ltd., Corporate Finance Research Office, etc., he founded an independent venture capital company in 1998 and became the representative director. While working on investment development of venture companies as a venture capitalist specializing in the founding period, he also provides consulting such as M & A and financial strategy as a specialist in corporate finance. In March 2016, he retired from the position of representative director of venture capital, and in April 2016, he became a professor at the Graduate School of Science and Technology Innovation, Kobe University (current position) and a professor at the Graduate School of Business Administration (current position). He has been in his current position since February 2019.

[What's Bio Palette Co., Ltd]

A startup from Kobe University that develops a drug discovery business using base editing technology, which is one of genome editing. Our core technology, base editing technology "Target-AID", is a genome editing technology developed from CRISPR-Cas9, and it is more accurate and precise because it does not involve cleavage of double-stranded DNA, which is a gene of an organism. Can be edited and applied to a wider variety of cells. In 2019, we signed an exclusive cross-licensing agreement with Beam Therapeutics of the United States regarding base editing technology including CRISPR-related technology, and secured the intellectual property rights necessary for commercialization. Development of innovative "microbiome therapy" that applies this technology to the breeding and modification of microorganisms that coexist in the human body and administers the bacteria themselves optimized by gene editing as a preparation (Living Medicine). Focus on.

[What's Synplogen Co., Ltd.]

A startup from Kobe University aiming to commercialize the world's most advanced genome synthesis technology. By making full use of cutting-edge genetic engineering, information science, and robotics, long-chain DNA required in the fields of bioindustry and medicine / biology can be "accurate", "low cost", and "short term" than before. We have the DNA synthesis technology "OGAB method" to synthesize. The OGAB method binds up to 50 DNA fragments in one step, and at present it is possible to obtain long-chain DNA of up to 100 kb with an extremely high probability of success. In the bio-industry field, especially in the bio-economy era, which aims for sustainable economic growth by providing accurate and long-chain DNA for gene therapy in the design of gene circuits used in the production of useful substances by microorganisms and in the medical field. Aim to be a key player in the economy.

From venture capitalist to graduate school professor

-Mr. Yamamoto started up a venture capital company by himself before he became a professor at Kobe University Graduate School. Could you tell us how you became a venture capitalist?

I graduated from Hitotsubashi University in 1988, and Japan's current account balance at that time was the largest in the world, and it was the time when the Japanese economy was the healthiest. It was also around the time when the academic field of corporate finance landed in Japan, and I was also studying corporate finance from a teacher returning from a business school in the United States in a university lecture.

At one point, the teacher talked to me. "Recently there is an interesting profession in America." They have a bachelor's degree in science and a bachelor's degree in business, and they ride in an open car to the board of directors of a company in a casual suit and sneakers, and give a keen opinion. Moreover, he seems to be very rich. I was very interested in knowing that it was a profession called "venture capitalist" that is not yet in Japan.

-Why did you choose Sumitomo Electric Industries as your place of employment instead of the financial industry?

When I was looking for a job, when I told a bank that I wanted to be a venture capitalist, I was recommended to the manufacturing industry. Currently, some companies in the manufacturing industry have stronger international competitiveness than finance. After studying industry, I was advised that if I got an MBA or studied finance in the United States, I might become a venture capitalist.

As an executive candidate, Sumitomo Electric has learned a wide range of topics from cost accounting to financial / management accounting and business strategy. I was thinking of studying abroad in about three years, but my father passed away due to illness and it became difficult to raise the cost of studying abroad, so I changed my job to Nomura Research Institute to learn cutting-edge financial theory and practical application. .. After that, he was involved in finance and management strategy at a venture company where his friend worked, and after gaining experience such as expanding sales from hundreds of millions of yen to billions of yen in four years, he became independent at the age of 34 in 1998. Established VC.

-What made you become a professor at the Graduate School of Science, Technology and Innovation, Kobe University in 2016?

The Graduate School of Science and Technology Innovation is a compulsory graduate school that teaches science students a skill set to connect science and technology breakthroughs to innovations of social and economic value. I received a consultation from my friend, a professor at Kobe University, to establish such a graduate school, and while helping to create a syllabus, I was invited to come as a faculty member.

I was interested in creating businesses with academia people, and also had experience teaching finance at graduate schools at Hitotsubashi University and Waseda University, so the company chose to leave it to a friend to specialize in graduate school.

-Before you established the graduate school and became a professor, you also established a company called Science and Technology Entrepreneurship (STE), which invests in ventures from universities and provides management guidance.

Professor Akihiko Kondo, Dean of the Graduate School of Science and Technology Innovation, asked us if we would like to commercialize the research results of the university, and STE and the STE Fund (Kobe University Science and Technology Entrepreneurship Fund) to invest in it. Was established. As a seed accelerator, we are involved in the research and development seeds of Kobe University from the stage of considering commercialization, and accompany them to the point where they can raise a large amount of funds from the outside.

Actually, I met Professor Kondo in a completely different place about 15 years before I was assigned to Kobe University. Shortly after the establishment of VC, I was asked to commercialize a certain research and development and spin it out, and it was Professor Kondo who was involved in that research. I don't think we'll meet again for the first time in 15 years and start a new challenge together. It was just a fateful coincidence (laughs).

A venture from Kobe University with cutting-edge genome editing and synthesis technology

-Biopalette and Synplogen, of which Mr. Yamamoto serves as a director, are startups from Kobe University established in 2017 with the support of STE. Please tell us about the business of the two companies.

First of all, Biopalette is a company that has genome editing technology (base editing technology) that does not cut DNA.

In the first place, genome editing is a technology that can freely rewrite all genetic information called "blueprint of life". "CRISPR-Cas9", which won the Nobel Prize in Chemistry in 2020, is also one of the technologies. It is effective for treating congenital diseases and improving the variety of agricultural products, especially in the medical field in the United States. Applications are progressing. Genome editing-related ventures created around 2013-2015 have a market value of up to 600 billion yen.

Conventional technologies such as "CRISPR-Cas9" are genome editing technologies that cut DNA. It is an excellent technology that pinpoints the target area and rewrites the genetic information, but the off-target effect that causes side effects by cutting the unintended area is an issue. Another problem is that it is difficult to apply to microorganisms such as bacteria that are not higher organisms.

-Isn't it the "non-cutting" technology of the bio-pallet that solves that problem?

Yes. In addition, although the dispute over the patent for "CRISPR-Cas9" has not yet been settled, we are steadily proceeding with the acquisition of patent rights for genome editing technology that cannot be cut by the biopalette. In addition, we have signed an exclusive cross-licensing agreement with Harvard University and Beam Therapeutics of the United States, which is licensed by collecting patents related to base editing held by MIT, and have established a system that allows mutual utilization of each technology. It took about a year to be signed by my company's patent attorney qualification and myself.

As a result, Biopalette has become the only company in the world that can handle base editing technology (genome editing technology) in the field of microbiota therapy. This is a very groundbreaking intellectual property strategy.

-What kind of company is Synplogen? Also, please tell us about the relationship with Biopalette.

Biopalette technology is "editing" the genome, while Synplogen technology is "synthesis". Using the core technology of long-chain DNA synthesis technology, it is possible to create microorganisms that produce useful substances from scratch. Currently, the two companies are operated separately, but in the future, we are looking at business development that makes use of both technologies of editing composites from scratch.

-Simplogen received an investment of 1 billion yen each from JAFCO in July 2019 and Biopalette in September 2020. How was the financing before that?

-Simplogen received an investment of 1 billion yen each from JAFCO in July 2019 and Biopalette in September 2020. How was the financing before that?

Biopalette was funded by a leading Boston VC in the year it was founded. The trigger was that a paper by Professor Keiji Nishida, who developed an inseparable genome editing technology together with Professor Kondo, was published in Science magazine in 2016. The VC who read it contacted me "I definitely want to meet a researcher", and when Professor Nishida went to the United States, he said "I want to invest" on the spot. It seems that he paid attention to us who have uncut genome editing technology because cutting genome editing has a risk in commercialization due to patent dispute.

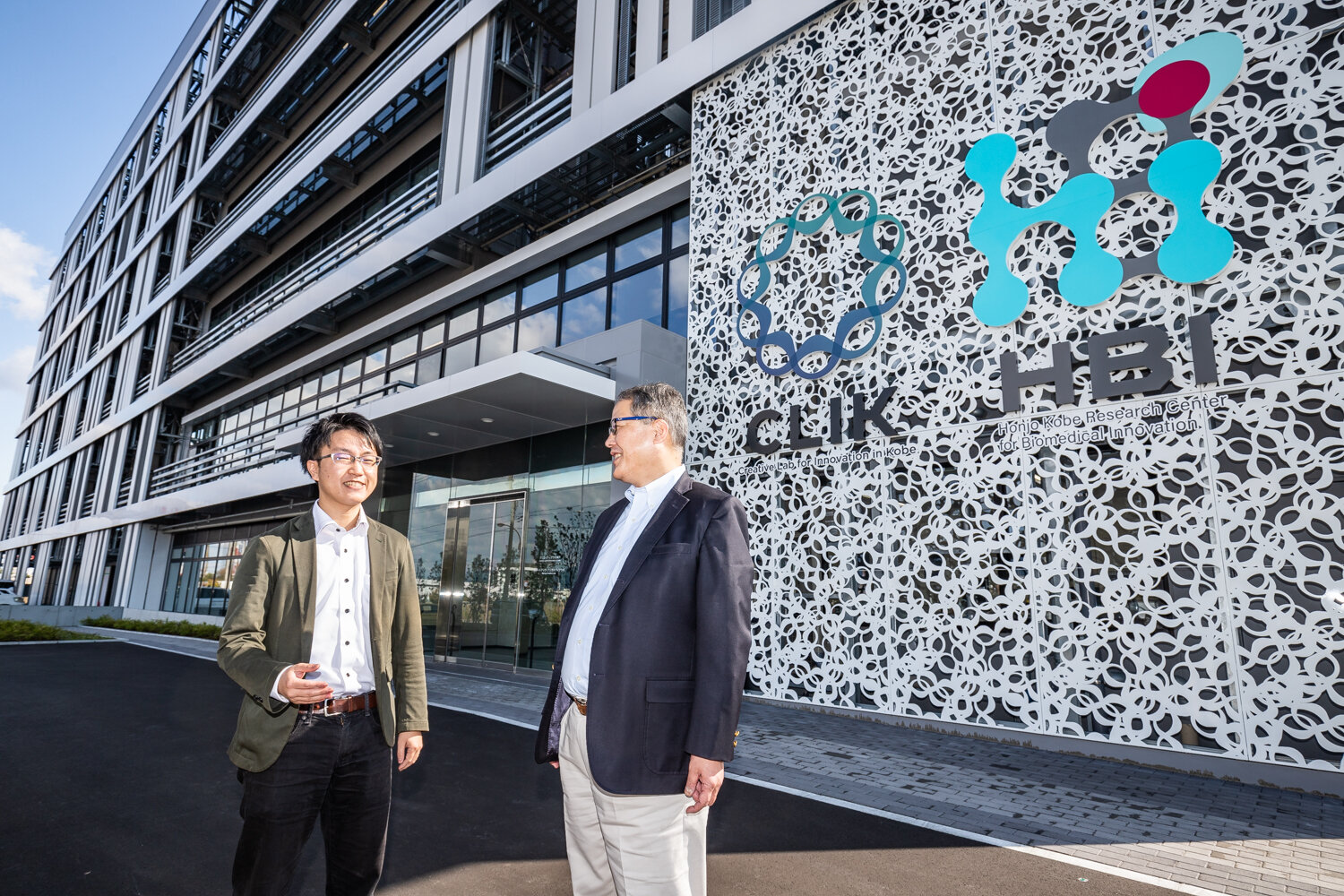

The following year, Professor Kondo and I produced a strategic capital and business alliance with a major bio-venture, and raised funds for Synplogen. It was around that time that I first met Mr. Miura of JAFCO.

-Why did you decide to raise money from Jafco?

Since we are doing business with technology developed using national funds, we were thinking of making the VC that Biopallet will receive the next investment in Japan.

Regarding Synplogen, if we receive investment from multiple companies, the opinions of VCs may differ and it may be difficult to manage, so I wanted to deal with only one company. However, a business like ours requires a billion yen in funding. When it comes to domestic VCs that can invest 1 billion yen at a time, the options were naturally limited to JAFCO.

Mr. Miura, the capitalist in charge, was a person who studied biotechnology at the Tokyo Institute of Technology graduate school, and he properly judged the value of our biotechnology, which has not yet sprouted. It was a fateful encounter because there are very few capitalists in Japan who are familiar with this area. Contrary to the confident email that was first sent to Professor Kondo, when I met him, he had a very soft personality (laughs), which was also a good impression.

-How will the funds raised this time be used?

Synplogen is used for the establishment of commercial laboratories for the purpose of long-chain DNA synthesis and for research and development for further advancement of technology. As the first step in entering the medical field, Biopallet will first develop therapeutic agents for periodontal disease and atopic dermatitis. We would like to aim for the treatment of diseases by balancing the microbiota (a population of bacteria in the human body) with our unique genome editing technology.

Mr. Yamamoto and Kengo Miura, the capitalist in charge of JAFCO (left)

Strong aspiration to "grow into a company that plays a central role in the 5th Industrial Revolution"

-Please tell us about the long-term vision of the two companies.

If possible, two companies, at least one, want to hit an off-site home run. In my opinion, an off-site home run is to have good investors invest in the long term and grow into a company that plays a central role in the Fourth Industrial Revolution. To that end, we would like to go public in the shortest time and aim for a market capitalization of at least 100 billion yen.

Biotechnology and the digital platforms that support it met around 2010-2013, and in the future there will be a global change called the Fifth Industrial Revolution, such as the shift from fossil fuels to biofuels that make effective use of biological resources. Huge investment in such fields is progressing in the United States, and China is desperate to overtake the United States. Japan, which was originally strong in biotechnology, is worried that it will slip out of developed countries as it is.

The laboratory of the Graduate School of Science, Technology and Innovation is littered with potential seeds. Biopallet and Synplogen are also companies that commercialized the seeds. Raising both companies may be the last chance to lay the foundation for Japan to keep up with the Fourth Industrial Revolution. I am working with such a feeling.

-What should we focus on in order for ventures in the bio-economy field to become globally competitive?

After all it is an intellectual property strategy. It is important not only to apply for a patent, but to analyze from an early stage in which country our technology is valuable and how we can gain a competitive advantage. Then, as in the case of the Bio Palette, you can proceed with negotiations in favor of technology.

I think it is more important for deep science to spend money thinking about how to strengthen intellectual property, rather than trying to monetize during the seed period.

-I would like to hear Mr. Yamamoto's frank thoughts on the ethics of genome editing technology, which is also called the "realm of God."

Science and technology are already in the realm of God. What I thought was an event in a science fiction movie is now a reality. With R & D and commercialization accelerating around the world, Japan must be on par with the world before it has a theological debate. Only if we can maintain a certain level of power in this field will we be in a position to establish rules regarding ethics and adjustment of interests.

-How has your job satisfaction changed between when you were running a VC and now?

I now realize the significance and efficiency of creating a business by treating the seeds of a professor of the same graduate school, that is, a colleague, at an early stage.

Usually, it is not uncommon for the founder entrepreneur to grow the company as it is, but in deep science, researchers rarely become entrepreneurs. Skills to bridge intellectual property and money during the founding period, skills to bridge intellectual property strategy and business strategy after receiving investment, skills to put the strategy into practice, listing / selling skills, etc. This is because the skills required of the team are completely different.

There are not many people in Japan who can bridge from breakthrough to innovation. As a university faculty member and as a startup strategy and finance expert, I will quickly implement the research results of my colleagues in society and return the returns to the university. Now that I am working toward that cycle, I feel that my horizons have expanded dramatically compared to when I was the owner of a single company.

-Can you give a message to entrepreneurs from venture capitalists, university faculty members, and Mr. Yamamoto, who has various experiences in investing and nurturing university-launched startups?

Enthusiasm alone is often not enough to fight in the world. It is necessary to prepare and train the minimum necessary weapons, and to gather and properly produce human resources who can fight together.

In the book "Five Skills of DNA-Destructive Innovators of Innovation" (2012 / Shoeisya) by the late Professor Clayton Christensen of Harvard Business School, "the ability to relate" as a skill common to innovative managers and entrepreneurs. Five of "questioning ability", "observation ability", "network ability", and "experimental ability" are introduced. I myself have only the ability to realize that it is true at this age, so I recommend that you consciously polish it on a daily basis.