On July 29, 2020, JAFCO signed a business alliance treaty with Money Forward, Inc., which has been supporting since its founding, and Money Forward Venture Partners, Inc. We will provide support for the introduction of "Money Forward Cloud" to JAFCO's investee companies free of charge, and will continue to support the back office support system for startups during the seed-early period.

We spoke with Mr. Katsuaki Kobu of Money Forward, Inc., Ltd. and Hiroki Setoyama, who is in charge of corporate consulting at JAFCO Group Co., Ltd., about the background to this business alliance, awareness of issues, and what we want to achieve in the future.

Money Forward, Inc. Katsuaki Kobu (left) and JAFCO Group Co., Ltd. Corporate Consulting Hiroki Setoyama (right)

Maintaining back office operations is a major issue for startups aiming for an IPO

-Please tell us the background behind JAFCO and Money Forward's decision to form a business alliance.

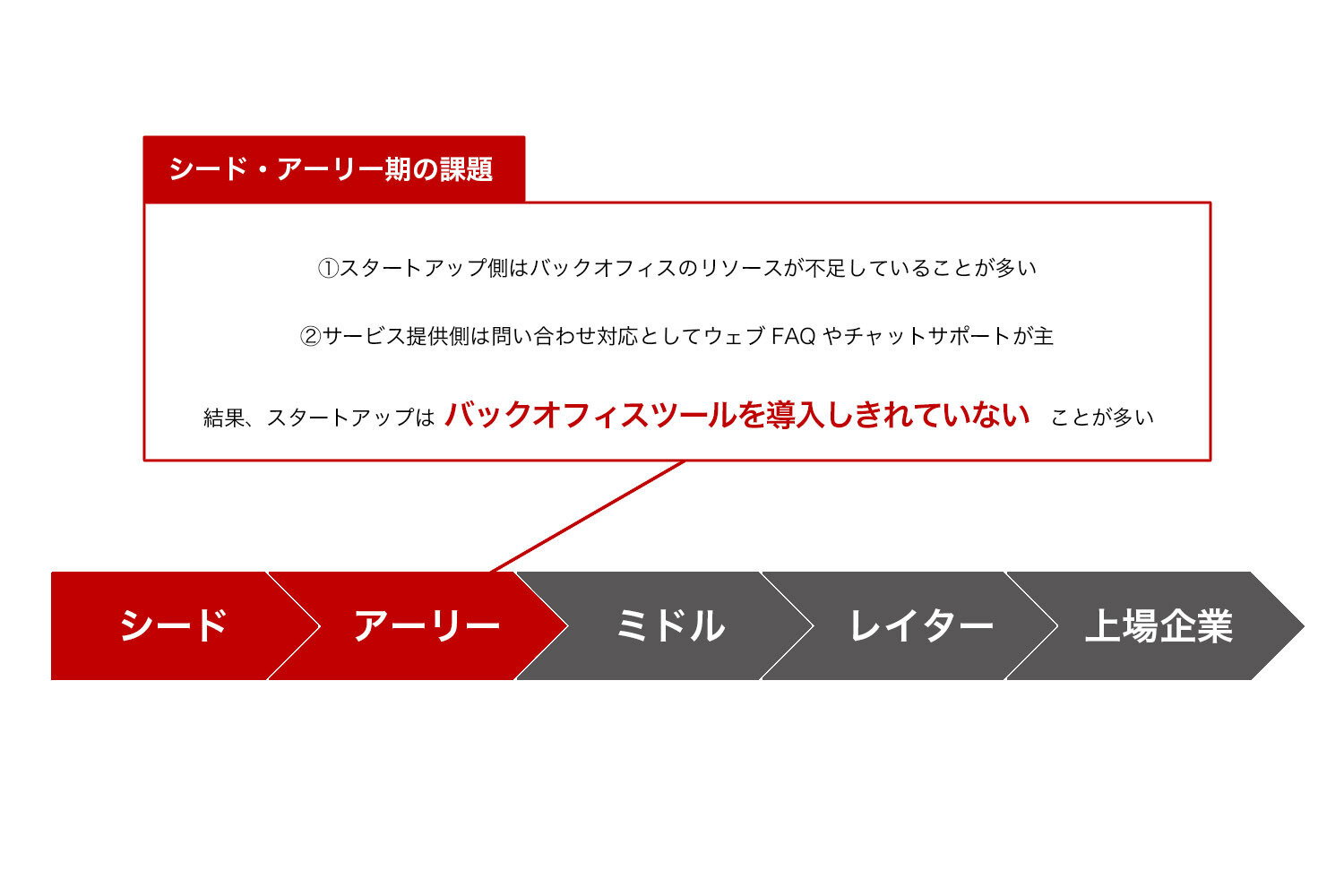

Setoyama For startups and SMEs, it is a difficult task to balance business development and back office operations. Originally, if we could improve work efficiency by introducing a system, we could devote our power to our main business, but we have no choice but to use limited human resources for urgent business issues. The current situation is that the maintenance of back office operations is not complete.

When I thought about how to improve the support for the back office system, especially the accounting system, the business alliance with Money Forward, which has a proven track record in the development of corporate accounting systems, was a very attractive idea.

Kobu: I was seconded from Money Forward to JAFCO in July 2020, but when I visited the investee company, I learned anew that management is having trouble with back office operations. When I actually saw the site, I realized that the high hurdles for introducing services such as data migration and getting used to how to use it are the bottleneck for improving the efficiency of back office operations. With this alliance, I strongly feel the significance of delivering services where startups need them most.

-In the first place, is it necessary to build a back office from the timing of the seed early period?

-In the first place, is it necessary to build a back office from the timing of the seed early period?

Setoyama At the stage of the Seed Early period, I don't think it is necessary to build internal control more than necessary. However, even if the organization is large, there are many cases where the construction of the back office system, especially the accounting system, is delayed, the monthly settlement and the final settlement are delayed, and as a result, management decision-making is delayed.

When starting a full-scale IPO preparation, it is very important to grasp the status of business performance = the current situation of the company in a timely manner. In particular, during the seed-early period, when the business foundation has not been established, the fluctuation range of business performance is large, and in some cases, it may be necessary to pivot the existing business, so timely performance management is necessary. I feel there is. It is important to create a minimum system from an early stage so that you can make a smooth transition to IPO preparation. Many of JAFCO's investee companies have said that they should have started earlier.

Kobu IPO Immediately before, a system that supports internal control is needed. From the stage when the system related to back office work is not in place IPO As preparations proceed, it will be necessary to drastically review the system, renew the system, and introduce new systems. As a result, a lot of time and power is spent.

During the seed-early period, the cost of the system is limited, but it is desirable to have a system that can be used up to IPO. There is a need for services that are easy to use, easy to understand, and can be introduced at low cost, and we believe that Money Forward cloud services can make a significant contribution.

Providing appropriate support according to the supporting company

-Please tell us in detail about the services provided by this business alliance.

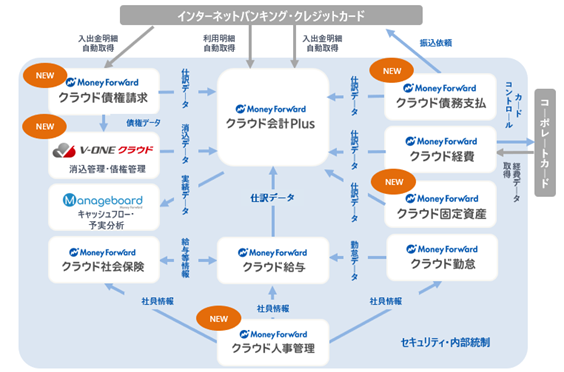

Setoyama JAFCO has accumulated know-how by providing support for "marketing and sales support," "HR support," and "back office construction support" in startup support so far. We have also provided various support for back office construction, but I found it difficult to support the selection and introduction of tools. With tools appearing at a dizzying pace and expanding their capabilities, it is not always possible to keep up with the latest information on which tool is best to use.

This time, with the cooperation of Money Forward, we will be able to select and support the introduction of tools according to each company by providing the tool introduction support support to the investee companies free of charge, and the range of "back office construction support" will be expanded. I think it can be expanded.

Kobu Money Forward, rather than simply supporting the introduction, I would like to provide various support at both JAFCO and Money Forward based on the introduction support. For example, for investee companies whose issue is that it takes time to close the monthly settlement, JAFCO and Money Forward will share their knowledge, propose operational improvements, and cooperate with other tools, and monthly. I would like to give comprehensive advice with an eye on the future, such as supporting the early settlement of accounts.

-What do you want to achieve in the future?

Setoyama The ideal organization for the IPO is to promote the introduction of appropriate systems from the beginning of the company's founding, establish a back office system that matches the stage of the company, and all employees understand the necessity. I would like to utilize the back office support know-how accumulated in JAFCO and the money forward system to establish a smooth system from the early stage of startup.

Kobu: I would like to create a system to solve problems, rather than a labor-intensive method. Through strong collaboration with Money Forward, we would like to create an environment where investee companies can focus on their original business expansion.